We are pleased to announce that the First GOSS International Forum on Private Equity (“GOSS PE Forum”) was successfully held on October 18-19, 2013 in Hong Kong, China. The theme of the GOSS PE Forum is “Decision-Making in PE Investment ”.

This conference is being organized by GOSS Institute of Research Management Ltd, which is an international research institute with a particular interest in decision-making theories and empirical research in the field of financial investment. Headquartered in Hong Kong, GOSS comprises an expert team of prominent scholars in related academic areas and a research team of specialists with extensive experience in the industry and outstanding academic backgrounds.

This year’s forum is co-sponsored by the Financial Engineering Laboratory at the Hong Kong University of Science and Technology, Manchester Business School of the University of Manchester, and Antai College of Economics and Management of Shanghai Jiao Tong University.

GOSS has identified many gaps related to the theoretical studies of PE - especially decision-making theories. Meanwhile, from the internal mechanism of PE we discovered that at any time point there exists a stochastic PE state and a set of random variables that could be used to describe the features of PE.

Based on this discovery, we collected data of close to 500 companies and performed statistical analyses using multiple methods, constructing “ probabilistic analysis models of PE investment decision making” from state space equations and Bayesian conditional probability theory.

This inspired the conception of the GOSS PE Forum. By holding this high-level conference, GOSS aims to promote a rational and healthy development for PE investment. We hope to guide the decision-making process towards a more scientific and efficient manner, and gradually build up influence in the PE field.

Prof. Siwei Cheng

Prof. Siwei ChengDean of the School of Management of the Graduate University of the Chinese Academy of Sciences; the Chairman of China Soft Science Research Association; President of the Chinese Society for Management Modernization; Director of the Research Centre on Fictitious Economy and Data Science, Chinese Academy of Sciences; the former Vice-Chairman of the Standing Committee of National People’ s Congresses

Show Detail hide Detail

Dean Cheng Siwei is a Chinese statesman and economist. He is also an Adjunct Professor and Doctoral Supervisor. His research mainly covers complexity science, fictitious economy, venture capital, chemical systems engineering, soft science and management science. He has published several books, including Chromic Salts Technology, Rejuvenating Chemical Industry through Science and Technology, Soft Science and Reform, Large Linear Target Programming and Application, Research in China's Economic Development and Reform and Economic Reform and Development in China. In 2010, he began having his works translated into English and published through Enrich Professional Publishing in Hong Kong, for a worldwide readership. The books Selected Works of Cheng Siwei, Economic Reforms and Development in China: Three-Volume Set are some of his most recent works. He has also published nearly 300 dissertations at home and abroad.

Prof. Tim Jenkinson

Prof. Tim JenkinsonProfessor of Finance and head of the finance faculty at Saïd Business School, University of Oxford; Director of the Oxford Private Equity Institute

Show Detail hide Detail

Tim Jenkinson is a Professor of Finance and head of the finance faculty at Saïd Business School, University of Oxford. He is also the Director of the Oxford Private Equity Institute. His areas of expertise include private equity, initial public offerings (IPOs), institutional asset management and the cost of capital.

Jenkinson is the leading European expert on IPOs and has conducted extensive research on the conflicts of interest inherent in the relationships between investment banks, investors and companies. His research has revealed how and why international investment banks charge significantly higher IPO fees to American companies compared with their European counterparts. This research on IPO discrepancies was published in the Journal of Finance and has attracted considerable media attention from publications such as The Economist, Reuters, The Financial Times, The New York Times, Wall Street Journal, Bloomberg, CNN, Time and various appearances on business new channels.

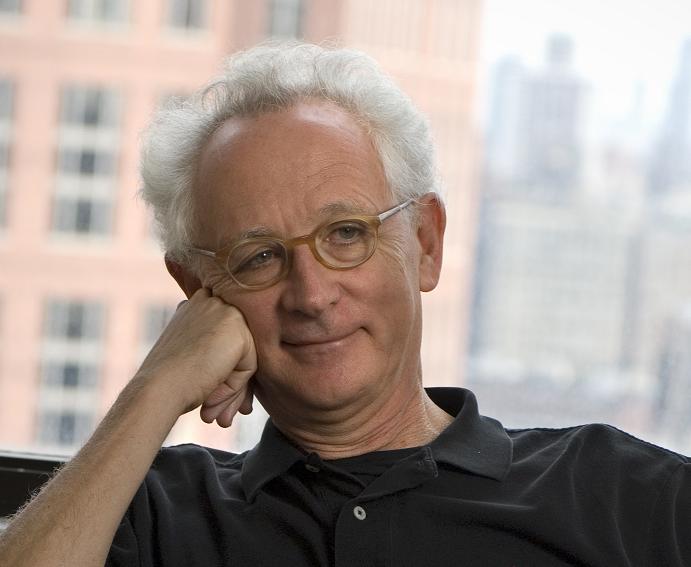

Prof. Emanuel Derman

Prof. Emanuel DermanCo-Head of Risk at Prisma Capital Partners and Professor at Columbia University

Show Detail hide Detail

EMANUEL DERMAN is Co-Head of Risk at Prisma Capital Partners and a professor at Columbia University, where he directs their program in financial engineering. His latest book is Models.Behaving.Badly: Why Confusing Illusion with Reality Can Lead to Disasters, On Wall Street and in Life, one of Business Week's top ten books of 2011. He is also the author of My Life As A Quant, also one of Business Week's top ten of 2004, in which he introduced the quant world to a wide audience.

He was born in South Africa but has lived most of his professional life in Manhattan, where he has made contributions to several fields. He started out as a theoretical physicist, doing research on unified theories of elementary particle interactions. At AT&T Bell Laboratories in the 1980s he developed programming languages for business modeling. From 1985 to 2002 he worked on Wall Street, running quantitative strategies research groups in fixed income, equities and risk management, and was appointed a managing director at Goldman Sachs & Co. in 1997. The financial models he developed there, the Black-Derman-Toy interest rate model and the Derman-Kani local volatility model, have become widely used industry standards.

In his 1996 article Model Risk Derman pointed out the dangers that inevitably accompany the use of models, a theme he developed in My Life as a Quant. Among his awards and honors, he was named the SunGard/IAFE Financial Engineer of the Year in 2000. He has a PhD in theoretical physics from Columbia University and is the author of numerous articles in elementary particle physics, computer science, and finance.

He writes a fortnightly column called Models Behaving Badly for the Frankfurter Allgemeine Zeitung.

Mr. Gongsheng Pan

Mr. Gongsheng PanDeputy Governor of the People’s Bank of China

Show Detail hide Detail

Mr. Pan joined the People’s Bank of China in June 2012 as one of the Deputy Governors. Before then, he served as the Executive Director and Vice President of the Agricultural Bank of China (ABC). He was well-known for his successful transformation of ABC and its large IPO in 2010. Before moving to the Agricultural Bank of China, Mr. Pan worked in the Industrial and Commercial Bank of China (ICBC) on a number of positions including as Deputy General Manager of Human Resources Department, Deputy General Manager of Financial Planning Department, Vice President of ICBC Shenzhen Branch, General Manager of Financial Planning Department, Director of ICBC Joint-Stock Reform Office, and Secretary of the Board of Directors. Mr. Pan is a research fellow and received his Ph.D. in economics from the Renmin University of China. He did his post-doctoral research at the Cambridge University and was a senior research fellow at the Harvard University.

Mr. Charles Li

Mr. Charles LiChief Executive Officer of the Hong Kong Stock Exchange

Show Detail hide Detail

Mr. Charles Li is Chief Executive of Hong Kong Exchanges and Clearing Limited (“HKEx”). Mr. Li has 20 years experience in the financial services sector, including corporate and securities law practices, corporate finance and advisory services in Hong Kong, the Mainland and New York.

Before joining HKEx, Mr. Li was chairman of J.P. Morgan China. Mr. Li has also worked for Merrill Lynch and was president of Merrill Lynch China. Before moving to Merrill Lynch in 1994, he practiced law in New York with Davis Polk & Wardwell and Brown & Wood.

He obtained a BA degree from Xiamen University of China in 1984, an MA degree from the University of Alabama in 1988 and a JD degree from Columbia University School of Law in New York in 1991.

Participation at the GOSS Forum is by invitation only. We will be inviting around 40 senior academics and practitioners to attend this inaugural event. These will include internationally renowned academic scholars as well as senior executives from the PE industry from Asia, America and Europe.

| Time | Event | Speaker |

| 9:00 | OPENING CEREMONY

CHAIRMAN SPEECH |

Mr. Quanjian Gao |

| 9:10 |

KEYNOTE SPEECH 1: Challenges and Opportunities Facing the PE Industry after the Financial Crisis |

Prof. Siwei Cheng |

| 9:50 |

PHOTO BREAK |

|

| 10:00 |

TALK 1: Comparisons of PE Decision-Making under Different Investment Environments -- Differences between the Chinese and Overseas Markets along with Their Impact | Mr. Yichen Zhang |

| 10:30 |

TALK 2: Developing Venture Capital Investment and Promoting Economic Transformation/Upgrade ? Making Full Use of the Effects and Catalytic Power of Venture Capital Investment amid Economic Transformation |

Mr. Haitao Jin |

| 11:00 |

BREAK |

|

| 11:15 |

KEYNOTE SPEECH 2: How Useful Is Past Performance When Picking Funds | Prof. Tim Jenkinson |

| 11:55 |

TALK 3: How to Choose Appropriate PE Investment Targets during the Economic Transformation ? looking at the problem from the perspective of platform enterprises |

Prof. Fangyu Fei |

| 12:25 |

LUNCH TALK 4: The Investment Strategy of Venture Capital in Taiwan LUNCH BREAK |

Prof. Lin Lin |

| 13:45 |

KEYNOTE SPEECH 3: Ways of Knowing |

Prof. Emanuel Derman |

| 14:25 |

TALK 5: Profit Sharing and Performance Fee between Fund Managers and Investors for Improved Satisfaction |

Prof. Steven Kou |

| 14:55 |

TALK6: Using Data and Analytics for PE Decisions | Mr. Tim Craighead |

| 15:25 |

BREAK Book signing by Prof. Emanuel Derman | |

| 15:45 |

TALK 7: Maximise Return for PEs through Capital Market and M&A Activities |

Mr. David Chin |

| 16:15 | TALK 8: PE Investment: Discovering Value and Adding Value | Mr. Wei Chen |

| 19:00 |

WELCOME DINNER & VICTORIA HARBOUR CRUISE TALK 9: IPO Issues and Challenges Facing Chinese Private Enterprises |

Mr. Henry Cai |

| Time | Event | Speaker |

| 9:00 |

KEYNOTE SPEECH 4: Trend of HK/Mainland Capital Markets and Implications to the PE Industry |

Mr. Charles Li |

| 9:40 |

TALK 10:: Does China's PE Industry Need a Transformation? How does It Transform? |

Mr. Antony K. Leung |

| 10:10 |

TALK 11:: Trends in the Private Equity Market |

Ms. Stephanie Hui |

| 10:40 | BREAK | |

| 10:55 | KEYNOTE SPEECH 5: Policy Support of New Ventures and Small/Medium Enterprises from the Chinese Government -- a Financial System Perspective |

Mr. Gongsheng Pan |

| 11:35 | TALK 12: Quantitative Methods in PE Decision Making Process -- A Hypothetical ANOVA Case Study | Prof. S. Stan Lan |

| 12:05 | CONFERENCE SUMMARY: EXECUTIVE CHAIRMAN SPEECH CLOSING CEREMONY |

Prof. Jeff Hong |

Financial Engineering Lab, IELM Dept., HKUST

Financial Engineering Lab, IELM Dept., HKUSTShow Detail hide Detail

Financial Engineering is an interdisciplinary field that involves economics, finance, mathematics, operations research and computer science. The FE Lab in the IELM Department at HKUST is founded and led by Prof. Jeff Hong, a professor of HKUST, a former Visiting Senior Financial Economist at the Shanghai Stock Exchange, and a former Visiting Professor of the NUS Business School at the National University of Singapore and the School of Management at Fudan University. The lab conducts research on designing efficient quantitative and computational methods to solve problems in financial investment and risk management, and applying quantitative and computational methods in understanding the behaviors of investors and financial markets.

The research work that conducted by the FE lab in the past includes risk measurement and management for derivative portfolios, computing Greek letters for exotic securities, portfolio selection with ambiguous downside risk measures or marginal risk measures, causal relationships between Chinese markets and world markets etc. Many of the research works have been published by top academic journals, including Operations Research and Management Science, and have won prestigious international research awards, including the 2012 INFORMS Simulation Society Outstanding Publication Award, 2009 IIE Transactions Best Paper Award, Second Prize of the 2007 INFORMS JFIG Paper Competition, and the 2011 IIE Prisker Doctoral Dissertation Award, 3rd Place.

Manchester Business School

Manchester Business School Show Detail hide Detail

Manchester Business School is the largest campus-based business and management school in the UK.

Original Thinking Applied

Manchester is recognised for its original thinkers: our long and proud history of research excellence continues the spirit of innovation and achievement for which the city is renowned. The School was one of the first two business schools in the UK (both founded in 1965).

We ’re ranked first in the UK for business research, but world-class research alone is not enough. Our original thinking is applied for impact across business and management, government and communities.

We provide world-class business and management education to undergraduates, postgraduates, experienced practitioners, and those with career orientated academicand research ambitions.

Manchester Business School delivers original thinking and teaching, informed by the contemporary commercial environment.

Why choose Manchester Business School?

Ranking:

· The 2013 Financial Times survey ranks our MBA 5th in the UK, 11th in

Europe and 29th in the world.

· Over the last three years The FT ranks us at an average position of 30. The

2013 FT survey also placed our students exposure to international business

21st in the world.

· The most recent Forbes survey, which ranks business schools on their “return

on investment ”(ROI) via a survey of alumni salaries, ranks our MBA

programme 2nd place outside the US, based on ROI.

Accreditation:

· MBS is part of a small and select band of institutions worldwide which are

accredited by all three major bodies - AACSB International, AMBA and EQUIS.

· The UK government body (HEFCE) ranks MBS teaching capabilities as

‘Excellent’, the highest category.

An international school:

· We have an extensive global network, with on-the-ground presence in Brazil,

China, Hong Kong, Singapore, UAE and the USA.

· Our School is truly international, preparing you for the global business

environment you'll encounter on graduation.

Antai College of Economics & Management, Shanghai Jiao Tong University,

Antai College of Economics & Management, Shanghai Jiao Tong University,Show Detail hide Detail

The Antai College of Economics & Management, Shanghai Jiao Tong University, aims to develop the highest-level economic and managerial talent, with totally international viewpoints and capacities, to compete in the global economy. While focusing on academic research, the college is also committed to serving national and international corporations and institutions, through leading-edge consulting and research. Already a top-ranked college in China, ACEM is striving to be recognized as a top economics and management College in Asia with a worldwide reputation.